Contents:

Companies withratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.Click here for more on how to use these ratings. Now could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorte… Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade.

- Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues.

- The Company’s global product offering includes consumable maintenance, repair and operating supplies, pipe, manual and automated valves, fittings, flanges, gaskets, fasteners, electrical, instrumentation, artificial lift, pumping solutions, and modular process, production, measurement and control equipment.

- Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity.

- It’s calculated by multiplying the current market price by the total number of shares outstanding.

- It’s calculated by dividing the current share price by the earnings per share .

Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. According to 3 analysts, the average rating for DNOW stock is « Strong Buy. » The 12-month stock price forecast is $13.67, which is an increase of 28.12% from the latest price. Now could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices.

Why Liberty Energy (LBRT) is a Go-to Stock in the Energy Space

Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company.

Premarket Mover: Frontline Plc (FRO) Up 1.69% – InvestorsObserver

Premarket Mover: Frontline Plc (FRO) Up 1.69%.

Posted: Mon, 17 Apr 2023 12:54:30 GMT [source]

Moody’s Daily what ought to petty cash funds be used for Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure.

DNOW Overview

They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. These are established companies that reliably pay dividends. The company offers its products under the DistributionNOW and DNOW brand names. It provides consumable maintenance, repair, and operating supplies; pipes, valves, fittings, flanges, gaskets, fasteners, electrical products, instrumentations, artificial lift, pumping solutions, valve actuation and modular pro…

Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. National Oilwell Varco Inc. said its second-quarter profit jumped 17%, driven by strong revenue growth across all of the oil-field-services equipment manufacturer’s segments. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. High-growth stocks tend to represent the technology, healthcare, and communications sectors.

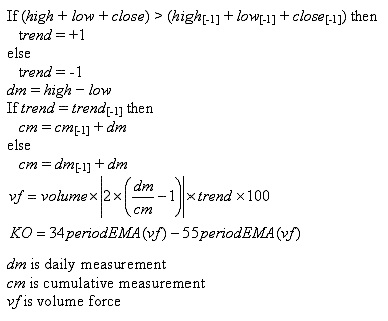

Stock Money Flow

The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes.

The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank.

Zacks Mobile App

52 week high is the highest price of a stock in the past 52 weeks, or one year. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues. HDSN, ENLC and DNOW made it to the Zacks Rank #1 momentum stocks list on November 7, 2022.

They have developed expertise in providing application systems, work processes, parts integration, optimization solutions & after-sales support. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Market cap, also known as market capitalization, is the total market value of a company. It’s calculated by multiplying the current market price by the total number of shares outstanding.

NOW Inc. distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation utilities, and industrial manufacturing operations in the United States, Canada, and internationally. It offers its products under the DistributionNOW and DNOW brand names. In addition, the company provides supply chain and materials management solutions that include procurement, inventory planning and management, and warehouse management, as well as solutions for logistics, point-of-issue technology, project management, business process, and performance metrics reporting services. The company was founded in 1862 and is headquartered in Houston, Texas. Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares.

Devon Energy’s (DVN) Q4 Earnings and Revenues Lag Estimates

News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. 52 week low is the lowest price of a stock in the past 52 weeks, or one year.

Is it Time to Dump Vertex Energy Inc (VTNR) Stock After it Is Down 1.23% in a Week? – InvestorsObserver

Is it Time to Dump Vertex Energy Inc (VTNR) Stock After it Is Down 1.23% in a Week?.

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. Now Inc will announce its quarterly financial results in 5 days. Traders should take this into account as the share price often fluctuates around this time period. Increased analyst coverage over the past few weeks may lead to solid price appreciation for stocks like Clearfield , DHT, AerSale , Leonardo DRS and NOW .

The Wall Street Journal

CompareDNOW’s historical performanceagainst its industry peers and the overall market. Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes.

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. We’d like to share more about how we work and what drives our day-to-day business.

If you are looking for stocks that have gained strong momentum recently but are still trading at reasonable prices, Now could be a great choice. Represents the company’s profit divided by the outstanding shares of its common stock. It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. It attempts to reflect the cash profit generated by a company’s operations. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings.

Should Oil & Gas Equipment & Services Stock Halliburton Company (HAL) Be in Your Portfolio Monday? – InvestorsObserver

Should Oil & Gas Equipment & Services Stock Halliburton Company (HAL) Be in Your Portfolio Monday?.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

The scores are based on the https://1investing.in/ styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Its solutions include outsourcing portions or entire functions of its customers procurement, warehouse and inventory management, logistics, point of issue technology, project management, business process and performance metrics reporting. NOW Incorp is a distributor to the oil and gas and industrial markets. Geographically, It operates in the United States, Canada, and International, Out of which the majority is from the United States. The Group’s product offering includes consumable maintenance, repair & operating supplies, pipe, manual and automated valves, fittings, flanges, gaskets, fasteners, electrical, instrumentation, artificial lift, pumping solutions and modular process, production, measurement & control equipment. They also offer procurement, warehouse & inventory management solutions as part of the company’s supply chain and materials management offering.

Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Generally, when stocks go up, the Australian dollar goes up with them. Often we refer to this correlation coefficient and how it can be used to help determine the possible…